Should I get an LL.M in Taxation Forum

Forum rules

Anonymous Posting

Anonymous posting is only appropriate when you are revealing sensitive employment related information about a firm, job, etc. You may anonymously respond on topic to these threads. Unacceptable uses include: harassing another user, joking around, testing the feature, or other things that are more appropriate in the lounge.

Failure to follow these rules will get you outed, warned, or banned.

Anonymous Posting

Anonymous posting is only appropriate when you are revealing sensitive employment related information about a firm, job, etc. You may anonymously respond on topic to these threads. Unacceptable uses include: harassing another user, joking around, testing the feature, or other things that are more appropriate in the lounge.

Failure to follow these rules will get you outed, warned, or banned.

-

Isaac_Adelman

- Posts: 4

- Joined: Fri Oct 28, 2016 1:11 pm

Should I get an LL.M in Taxation

I am a 2L, with a concentration in taxation. Would getting an LL.M in taxation really make a big difference to my career outlook?

Gracias

Gracias

-

haus

- Posts: 3896

- Joined: Wed Aug 18, 2010 11:07 am

Re: Should I get an LL.M in Taxation

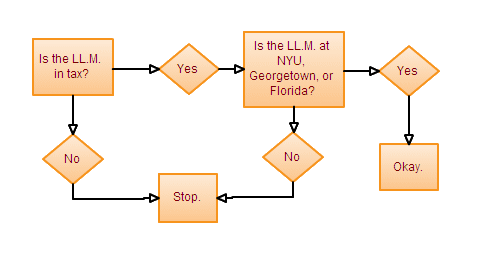

Stealing my own comment from...haus wrote: For humor purposes only...

ETA: source: http://www.top-law-schools.com/forums/v ... 3&t=10440020130312 wrote:

http://www.top-law-schools.com/forums/v ... M#p8271289

Both threads may be of interest to you.

But perhaps you might want to look for profiles and or LinkedIn pages for attorneys at firms/companies you might be interested in, and see how many of them have earned LLMs.

- Johann

- Posts: 19704

- Joined: Wed Mar 12, 2014 4:25 pm

Re: Should I get an LL.M in Taxation

not necessary to practice tax if you land biglaw in OCI. necessary to practice tax law for most people that dont land biglaw/big 4 in oci hiring.

-

Anonymous User

- Posts: 432844

- Joined: Tue Aug 11, 2009 9:32 am

Re: Should I get an LL.M in Taxation

I'm in at Northwestern for the LLM in Taxation. Would that suffice you think?haus wrote:Stealing my own comment from...haus wrote: For humor purposes only...

ETA: source: http://www.top-law-schools.com/forums/v ... 3&t=10440020130312 wrote:

http://www.top-law-schools.com/forums/v ... M#p8271289

Both threads may be of interest to you.

But perhaps you might want to look for profiles and or LinkedIn pages for attorneys at firms/companies you might be interested in, and see how many of them have earned LLMs.

-

sawyercb

- Posts: 46

- Joined: Thu Oct 27, 2016 2:46 pm

Re: Should I get an LL.M in Taxation

I agree with this.JohannDeMann wrote:not necessary to practice tax if you land biglaw in OCI. necessary to practice tax law for most people that dont land biglaw/big 4 in oci hiring.

Also, first, it totally depends on your current grades. Are you currently at the top of your class with good job prospects post-graduation? If so, a tax LLM is unnecessary for biglaw (with the exception of a couple of firms that still insist on it for some reason). If not, consider a tax LLM to boost your resume and job prospects. Be aware that if you have bad grades from law school, a tax LLM does not fix it and will not necessary land you a biglaw tax gig.

I would not take time off from practicing to go to any school other than NYU. If you want to take night classes to help you practice tax better on a day to day basis, I think it's a different conversation. IMO, in that case, you can take night classes part time at any reasonable local school that offers a tax LLM program. I know tons of tax attorneys who have an LLM from a no-name school that they acquired at night while working full time. I think you can acquire the same information with less time & money by just attending webinars / seminars / conferences here and there, focusing on the subjects that will help you most in your day to day practice.

FWIW, I am a current tax associate at a large law firm, and lateralled from a different market where I was a tax associate at another large law firm. I do not have an LLM.

Want to continue reading?

Register now to search topics and post comments!

Absolutely FREE!

Already a member? Login

-

Isaac_Adelman

- Posts: 4

- Joined: Fri Oct 28, 2016 1:11 pm

Re: Should I get an LL.M in Taxation

I am at U of C, average grades 3.3 GPA, wrote on for Law Journal (nothing major.) I did get the JP award in my Secured Trans class and was a research assistant for one of my Profs. I also TA'ed for a semester (Contracts). I like tax a lot and applied and found out not, too long ago that I got in at Northwestern for my LLM in tax. But like your advice, too. Thanks for it.sawyercb wrote:I agree with this.JohannDeMann wrote:not necessary to practice tax if you land biglaw in OCI. necessary to practice tax law for most people that dont land biglaw/big 4 in oci hiring.

Also, first, it totally depends on your current grades. Are you currently at the top of your class with good job prospects post-graduation? If so, a tax LLM is unnecessary for biglaw (with the exception of a couple of firms that still insist on it for some reason). If not, consider a tax LLM to boost your resume and job prospects. Be aware that if you have bad grades from law school, a tax LLM does not fix it and will not necessary land you a biglaw tax gig.

I would not take time off from practicing to go to any school other than NYU. If you want to take night classes to help you practice tax better on a day to day basis, I think it's a different conversation. IMO, in that case, you can take night classes part time at any reasonable local school that offers a tax LLM program. I know tons of tax attorneys who have an LLM from a no-name school that they acquired at night while working full time. I think you can acquire the same information with less time & money by just attending webinars / seminars / conferences here and there, focusing on the subjects that will help you most in your day to day practice.

FWIW, I am a current tax associate at a large law firm, and lateralled from a different market where I was a tax associate at another large law firm. I do not have an LLM.

-

sawyercb

- Posts: 46

- Joined: Thu Oct 27, 2016 2:46 pm

Re: Should I get an LL.M in Taxation

Sure! Good luck, if you decide to go. Tax is awesome.Isaac_Adelman wrote:quote]

I am at U of C, average grades 3.3 GPA, wrote on for Law Journal (nothing major.) I did get the JP award in my Secured Trans class and was a research assistant for one of my Profs. I also TA'ed for a semester (Contracts). I like tax a lot and applied and found out not, too long ago that I got in at Northwestern for my LLM in tax. But like your advice, too. Thanks for it.

-

Anonymous User

- Posts: 432844

- Joined: Tue Aug 11, 2009 9:32 am

Re: Should I get an LL.M in Taxation

Sort of off topic, but would a tax LLM be a complete waste of time if I will have taken Fed Income, Corporate, Partnership, International, and Exempt Orgs by the time I get my JD? Is there anything I'd actually be missing?

-

Anonymous User

- Posts: 432844

- Joined: Tue Aug 11, 2009 9:32 am

Re: Should I get an LL.M in Taxation

I feel it might get your foot in the door, especially if the LLM Tax program is at a highly regarded program i.e. NYU, Northwestern etc.Anonymous User wrote:Sort of off topic, but would a tax LLM be a complete waste of time if I will have taken Fed Income, Corporate, Partnership, International, and Exempt Orgs by the time I get my JD? Is there anything I'd actually be missing?

-

Anonymous User

- Posts: 432844

- Joined: Tue Aug 11, 2009 9:32 am

Re: Should I get an LL.M in Taxation

If you're median at U of C you probably really don't need it. I'm a tax associate at a band 1 chicago tax firm and almost no one has LLMs. With that being said I took every substantive tax elective I could and I feel like its helped with the learning curve, but I don't think getting an entire LLM is necessary as no one really expects you to be substantively knowledgeable coming in.Isaac_Adelman wrote:I am at U of C, average grades 3.3 GPA, wrote on for Law Journal (nothing major.) I did get the JP award in my Secured Trans class and was a research assistant for one of my Profs. I also TA'ed for a semester (Contracts). I like tax a lot and applied and found out not, too long ago that I got in at Northwestern for my LLM in tax. But like your advice, too. Thanks for it.sawyercb wrote:I agree with this.JohannDeMann wrote:not necessary to practice tax if you land biglaw in OCI. necessary to practice tax law for most people that dont land biglaw/big 4 in oci hiring.

Also, first, it totally depends on your current grades. Are you currently at the top of your class with good job prospects post-graduation? If so, a tax LLM is unnecessary for biglaw (with the exception of a couple of firms that still insist on it for some reason). If not, consider a tax LLM to boost your resume and job prospects. Be aware that if you have bad grades from law school, a tax LLM does not fix it and will not necessary land you a biglaw tax gig.

I would not take time off from practicing to go to any school other than NYU. If you want to take night classes to help you practice tax better on a day to day basis, I think it's a different conversation. IMO, in that case, you can take night classes part time at any reasonable local school that offers a tax LLM program. I know tons of tax attorneys who have an LLM from a no-name school that they acquired at night while working full time. I think you can acquire the same information with less time & money by just attending webinars / seminars / conferences here and there, focusing on the subjects that will help you most in your day to day practice.

FWIW, I am a current tax associate at a large law firm, and lateralled from a different market where I was a tax associate at another large law firm. I do not have an LLM.

- Mullens

- Posts: 1138

- Joined: Wed Dec 18, 2013 1:34 am

Re: Should I get an LL.M in Taxation

I'm guessing U of C here doesn't mean University of Chicago since they have a different grading system.Anonymous User wrote:If you're median at U of C you probably really don't need it. I'm a tax associate at a band 1 chicago tax firm and almost no one has LLMs. With that being said I took every substantive tax elective I could and I feel like its helped with the learning curve, but I don't think getting an entire LLM is necessary as no one really expects you to be substantively knowledgeable coming in.Isaac_Adelman wrote:I am at U of C, average grades 3.3 GPA, wrote on for Law Journal (nothing major.) I did get the JP award in my Secured Trans class and was a research assistant for one of my Profs. I also TA'ed for a semester (Contracts). I like tax a lot and applied and found out not, too long ago that I got in at Northwestern for my LLM in tax. But like your advice, too. Thanks for it.sawyercb wrote:I agree with this.JohannDeMann wrote:not necessary to practice tax if you land biglaw in OCI. necessary to practice tax law for most people that dont land biglaw/big 4 in oci hiring.

Also, first, it totally depends on your current grades. Are you currently at the top of your class with good job prospects post-graduation? If so, a tax LLM is unnecessary for biglaw (with the exception of a couple of firms that still insist on it for some reason). If not, consider a tax LLM to boost your resume and job prospects. Be aware that if you have bad grades from law school, a tax LLM does not fix it and will not necessary land you a biglaw tax gig.

I would not take time off from practicing to go to any school other than NYU. If you want to take night classes to help you practice tax better on a day to day basis, I think it's a different conversation. IMO, in that case, you can take night classes part time at any reasonable local school that offers a tax LLM program. I know tons of tax attorneys who have an LLM from a no-name school that they acquired at night while working full time. I think you can acquire the same information with less time & money by just attending webinars / seminars / conferences here and there, focusing on the subjects that will help you most in your day to day practice.

FWIW, I am a current tax associate at a large law firm, and lateralled from a different market where I was a tax associate at another large law firm. I do not have an LLM.

Register now!

Resources to assist law school applicants, students & graduates.

It's still FREE!

Already a member? Login