5747 Forum

Forum rules

Anonymous Posting

Anonymous posting is only appropriate when you are revealing sensitive employment related information about a firm, job, etc. You may anonymously respond on topic to these threads. Unacceptable uses include: harassing another user, joking around, testing the feature, or other things that are more appropriate in the lounge.

Failure to follow these rules will get you outed, warned, or banned.

Anonymous Posting

Anonymous posting is only appropriate when you are revealing sensitive employment related information about a firm, job, etc. You may anonymously respond on topic to these threads. Unacceptable uses include: harassing another user, joking around, testing the feature, or other things that are more appropriate in the lounge.

Failure to follow these rules will get you outed, warned, or banned.

-

shotsfired12

- Posts: 204

- Joined: Thu Jun 25, 2009 8:36 am

- Helmholtz

- Posts: 4128

- Joined: Wed Sep 17, 2008 1:48 pm

Re: Death of Wall Streets = Death of Big Law?

Dodd-Frank bad for biglaw?SHANbangs wrote:I know this post is just going to prompt more speculation than anything, but I'd love to hear your intelligent opinions regarding the effect of wall street's demise on big transactional law. I mean, obviously a double dip or the potential EU blow up will not be good for hiring in the next few years, but what about these new banking regulations? Any thoughts on the relationship between Dodd-Frank and Volcker Rule, and big transactional business?

http://www.nytimes.com/2011/09/09/busin ... wanted=all

Also, wtf is all this about Wall Street's demise?

-

mrloblaw

- Posts: 534

- Joined: Fri Jul 22, 2011 3:00 pm

Re: Death of Wall Streets = Death of Big Law?

I'm pretty sure everybody is going to be more or less equally screwed once double-dip comes along.

Except, you know, those who already have experience in the thriving roving-band-of-vagrant-scavengers market; it'll be their time to shine.

Except, you know, those who already have experience in the thriving roving-band-of-vagrant-scavengers market; it'll be their time to shine.

- omninode

- Posts: 405

- Joined: Tue Oct 12, 2010 2:09 pm

Re: Death of Wall Streets = Death of Big Law?

What's this about the death of Wall Street?

There may be a few more lean years ahead, but Wall Street is not going anywhere. They created mountains of artificial wealth out of worthless assets in the 00's and, god willing, they're going to do it again.

There may be a few more lean years ahead, but Wall Street is not going anywhere. They created mountains of artificial wealth out of worthless assets in the 00's and, god willing, they're going to do it again.

-

duckfan00

- Posts: 13

- Joined: Sun Nov 30, 2008 9:57 am

Re: Death of Wall Streets = Death of Big Law?

Omni-

Do you have to be so honest???...

Do you have to be so honest???...

Want to continue reading?

Register now to search topics and post comments!

Absolutely FREE!

Already a member? Login

-

BeenDidThat

- Posts: 695

- Joined: Thu Feb 03, 2011 12:18 am

Re: Death of Wall Streets = Death of Big Law?

The bolded aside (as it has been handled pretty well by previous posters), increased regulation will most likely help, not hurt, those lucky enough to make it into big law firms. Lawyers are needed for advice on the reach and scope of regulations, how to comply, how to structure deals, and for the handling the inevitable regulatory actions that will result under new laws. It's unclear how the changing regulatory environment will affect smaller firms, but for those in the ranks of big law, it should only help. And the increase in demand for legal services may well swell the ranks of big law.SHANbangs wrote:I know this post is just going to prompt more speculation than anything, but I'd love to hear your intelligent opinions regarding the effect of wall street's demise on big transactional law. I mean, obviously a double dip or the potential EU blow up will not be good for hiring in the next few years, but what about these new banking regulations? Any thoughts on the relationship between Dodd-Frank and Volcker Rule, and big transactional business?

- Julio_El_Chavo

- Posts: 803

- Joined: Mon Jan 31, 2011 11:09 pm

Re: Death of Wall Streets = Death of Big Law?

LOL @ Wall Street being "dead." There are a healthy number of deals being done right now and the corporate lateral market is picking up. Do you really think rich Wall Street guys are ever going to let the financial system collapse? There's no way. They have too much power and influence in Washington. The country will see double digit inflation before Wall Street goes under. Bailouts are the new normal.

- MrPapagiorgio

- Posts: 1740

- Joined: Sat Feb 13, 2010 2:36 am

Re: Death of Wall Streets = Death of Big Law?

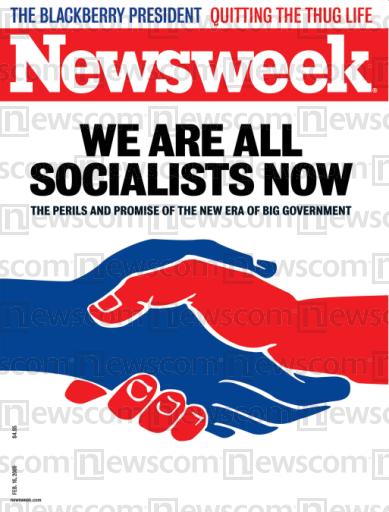

Julio_El_Chavo wrote:Bailouts are the new normal.

-

Renzo

- Posts: 4249

- Joined: Tue Dec 02, 2008 3:23 am

Re: Death of Wall Streets = Death of Big Law?

Nothing here will be bad for biglaw specifically, and some of it is good. If the European banks fail, however, it's going to be mind-blowingly, horror-movie bad for everyone everywhere, lawyers included.SHANbangs wrote:I know this post is just going to prompt more speculation than anything, but I'd love to hear your intelligent opinions regarding the effect of wall street's demise on big transactional law. I mean, obviously a double dip or the potential EU blow up will not be good for hiring in the next few years, but what about these new banking regulations? Any thoughts on the relationship between Dodd-Frank and Volcker Rule, and big transactional business?

- Old Gregg

- Posts: 5409

- Joined: Thu Sep 01, 2011 1:26 pm

Re: Death of Wall Streets = Death of Big Law?

Depends on the law firm and their exposure to euro banks, either in terms of their clients being those banks or their clients being banks who are exposed to those banks. In terms of the latter, local banks are fairly well hedged in the event of a PIIGS default. In terms of the former, not that many American law firms get so much work from euro banks (the only one that comes immediately to mind is Davis Polk and Santander, but that is hardly the bread and butter of their practice). Litigation-focused firms especially won't feel the hit. They're already overloaded with work to do, and litigation won't just stop if euro banks collapse. To be sure, local companies here in the States have amassed massive financial warchests with which to pursue their objectives, either in the form of a merger or in the form of litigation. Just because companies aren't hiring and putting out more jobs in the economy, doesn't mean they can't afford to do so. They have the money, but are using it for other things. These things are giving lawyers business, and the resources with which to do them are unlikely to evaporate overnight.If the European banks fail, however, it's going to be mind-blowingly, horror-movie bad for everyone everywhere, lawyers included.

There's a lot of talk here about "double-dip," but that's sort of a flawed way of looking at the picture. The reality is that we were never out of a recession in the first place (as much as the Fed would like to insist otherwise). We're really almost scraping at the bottom of the barrel, and have been doing so for a while; and I say "almost" because the real bottom of the barrel was mid-2009, when the credit and capital markets basically froze. That really isn't the case here since American banks aren't so highly leveraged on a Euro default, have increased capital to reduce risk, and if they are leveraged, they've surely hedged their positions with insurers who follow new collateral regulations. Yes, there will be a significant reduction in capital if the Euro banks collapse, but M&A originating in the US seeks financing from a handful of banks. None of them are European.

In other words, if you're at a firm with strong a litigation, intellectual property, or restructuring practice (and you're in one of those groups), you're pretty safe. If you're in the corporate group of a large law firm, being at a Vault 10 or so probably provides decent security, though it's not as safe as being in the above groups. If you're at Katten Muchin corporate in Chicago, however, I'd be shaking in my boots if I were you.

-

Renzo

- Posts: 4249

- Joined: Tue Dec 02, 2008 3:23 am

Re: Death of Wall Streets = Death of Big Law?

No, I stand by mind-blowing, horror movie bad.Fresh Prince wrote:Depends on the law firm and their exposure to euro banks, either in terms of their clients being those banks or their clients being banks who are exposed to those banks. In terms of the latter, local banks are fairly well hedged in the event of a PIIGS default. In terms of the former, not that many American law firms get so much work from euro banks (the only one that comes immediately to mind is Davis Polk and Santander, but that is hardly the bread and butter of their practice). Litigation-focused firms especially won't feel the hit. They're already overloaded with work to do, and litigation won't just stop if euro banks collapse. To be sure, local companies here in the States have amassed massive financial warchests with which to pursue their objectives, either in the form of a merger or in the form of litigation. Just because companies aren't hiring and putting out more jobs in the economy, doesn't mean they can't afford to do so. They have the money, but are using it for other things. These things are giving lawyers business, and the resources with which to do them are unlikely to evaporate overnight.If the European banks fail, however, it's going to be mind-blowingly, horror-movie bad for everyone everywhere, lawyers included.

There's a lot of talk here about "double-dip," but that's sort of a flawed way of looking at the picture. The reality is that we were never out of a recession in the first place (as much as the Fed would like to insist otherwise). We're really almost scraping at the bottom of the barrel, and have been doing so for a while; and I say "almost" because the real bottom of the barrel was mid-2009, when the credit and capital markets basically froze. That really isn't the case here since American banks aren't so highly leveraged on a Euro default, have increased capital to reduce risk, and if they are leveraged, they've surely hedged their positions with insurers who follow new collateral regulations. Yes, there will be a significant reduction in capital if the Euro banks collapse, but M&A originating in the US seeks financing from a handful of banks. None of them are European.

In other words, if you're at a firm with strong a litigation, intellectual property, or restructuring practice (and you're in one of those groups), you're pretty safe. If you're in the corporate group of a large law firm, being at a Vault 10 or so probably provides decent security, though it's not as safe as being in the above groups. If you're at Katten Muchin corporate in Chicago, however, I'd be shaking in my boots if I were you.

If there is a sovereign default in the Eurozone, there might not be a bank left standing on the continent (ok, that's a slight exaggeration, but it will be dire). It would make the American credit crisis look like a joke. And, just as it did in the US, this will trickle down to the real economy when firms and individuals realize capital losses and lose access to credit. Recession and credit freeze across Europe will spread to the US, even if our banks are adequately hedged. And if we double dip (which is proper terminology, even if we are just talking about a downward trend away from recovery). We'll be standing in breadlines and selling pencils on the street corner, just like those old-timey photos of the great depression. Greece and Portugal will look more like Mad Max.

- Bronte

- Posts: 2125

- Joined: Sun Jan 04, 2009 10:44 pm

Re: Death of Wall Streets = Death of Big Law?

What is this, 2008?

-

Anonymous User

- Posts: 432829

- Joined: Tue Aug 11, 2009 9:32 am

Re: Death of Wall Streets = Death of Big Law?

If the Euro fails it will be 1930.Bronte wrote:What is this, 2008?

Register now!

Resources to assist law school applicants, students & graduates.

It's still FREE!

Already a member? Login

- Bronte

- Posts: 2125

- Joined: Sun Jan 04, 2009 10:44 pm

Re: Death of Wall Streets = Death of Big Law?

Lol. Take it to the recession panic megathread. If you go back a few years, you can read us all mocking the "wall street and big law are dead" alarmists.Anonymous User wrote:If the Euro fails it will be 1930.Bronte wrote:What is this, 2008?

-

Renzo

- Posts: 4249

- Joined: Tue Dec 02, 2008 3:23 am

Re: Death of Wall Streets = Death of Big Law?

Or maybe 900 A.D.Anonymous User wrote:If the Euro fails it will be 1930.Bronte wrote:What is this, 2008?

- IrwinM.Fletcher

- Posts: 1268

- Joined: Mon Jun 27, 2011 2:55 pm

Re: Death of Wall Streets = Death of Big Law?

He's right though. We all have to hope and pray it doesn't happen, but this week has a very non-negligible chance of being a repeat of Lehman Brothers weekend in September 2008 (only worse). I'm slated for transactional this summer so I'm leading the cheerleading squad for the plunge protection team on wall street.Bronte wrote:Lol. Take it to the recession panic megathread. If you go back a few years, you can read us all mocking the "wall street and big law are dead" alarmists.Anonymous User wrote:If the Euro fails it will be 1930.Bronte wrote:What is this, 2008?

Normally I'd agree that this stuff belongs in a megapanic thread, but for now, it's current events and it seems fair to discuss it.

-

Renzo

- Posts: 4249

- Joined: Tue Dec 02, 2008 3:23 am

Re: Death of Wall Streets = Death of Big Law?

I'm not saying that Wall Street or Biglaw are dead. I'm saying the economy as we know it will be dead, and Wall Street and Biglaw will suffer secondarily because of it.Bronte wrote:Lol. Take it to the recession panic megathread. If you go back a few years, you can read us all mocking the "wall street and big law are dead" alarmists.Anonymous User wrote:If the Euro fails it will be 1930.Bronte wrote:What is this, 2008?

As that scare-mongering, anti-bank tabloid called "The Economist" puts it:

Get unlimited access to all forums and topics

Register now!

I'm pretty sure I told you it's FREE...

Already a member? Login