mec30 wrote:To correct a few errors.

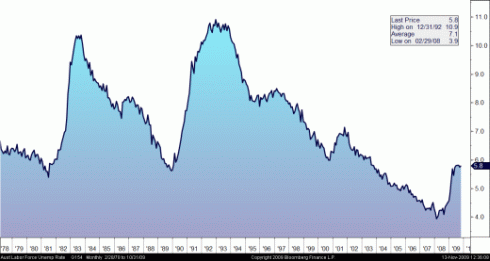

ravens9111 wrote:The fact is that unemployment is really 17%. U6 is the real unemployment rate.

The measure your referring to includes people who are underemployed and people who don't need to work but would like to supplement their income. One of the main reasons this isn't a reliable measure to look is because this number, as a percentage of the ILO unemployment rate, will continue to rise as the baby boomers retire and become underemployed and/or seek to find a low paying job to supplement their SS/retirement income. It's not a good indicator of the health of the economy.

That's not entirely accurate. U6 unemployment includes laid off workers, temp. workers, discouraged workers (those that have given up looking for work because they believe no work is available for them), "marginally or loosely attached workers", those who have not looked for work recently, and the underemployed (those who would like to work full time, but are only able to work part time). Your example of the baby boomers is valid, but most retirees who live on SS/retirement income don't seek a full time job. When supplementing income, they would seek a part time job. That would not make them underemployed. They would be considered part time workers. Of course, I am sure some of the baby boomers could work part time while seeking full time employment. I don't think that is in the majority. Maybe I am wrong. One more thing, those that give up and decide to go to school are no longer included in the labor force. They are completely off the rolls.

ravens9111 wrote:The stimulus package was opposed by the majority of economists because the money to be spent did not have a multiplier effect for the private sector.

The stimulus package was not opposed by the majority of economists, nor was it opposed by the ones that did for that reason.

You may be right that the majority of economists did not oppose the stimulus. There are more Keynesian's out there than I thought. I am more of an Austrian School type myself. I will give you that one.

ravens9111 wrote:We have to cut spending, raise the retirement age for social security (or cut it completely)

The retirement age (the age at which you can start receiving benefits) is already raised for each successive generation depending on your date of birth.

That maybe true, but the life expectancy has also continued to increase. We can't afford to pay SSI for 10 or 20 years per individual. About 25% of our population will be eligible for SSI within the next 10 to 20 years. The baby boomers are coming to retirement age. The whole system is a ponzi scheme. Someone is going to be left holding the bag when the money runs out. I suppose if you really want to keep the system in place, we can raise the payroll taxes and create another problem all together.

repeal the Healthcare Bill

Per the CBO the bill reduces government spending over a ten year period, and more after that.

Yup, can't dispute what the CBO said BEFORE the bill was passed. Unfortunately, the CBO also did their analysis based on increased taxes for four years before services would begin. In other words, the first ten years of passage, the system will collect ten years of taxes while only providing six years of services. The real problem will occur after the first ten years when you pay ten years of taxes and provide ten years of services.

Instead, he will keep spending and raise everyone's taxes.

The way this is worded suggests that Obama has already raised taxes, which is not the case. In fact they are the lowest they have been in decades. And other than the sunset provisions of the 2004 tax cuts, the effective tax rates will remain (as of the latest news) the same.

The healthcare bill is pretty much a tax on everyone. That has already passed. We will be paying for that very soon, no? Also, the tax cuts are due to expire after this year. Not to mention, cap and trade is next on the agenda. As Obama put it, "gas prices will necessarily skyrocket". The cap and trade may not go through. Time will tell.

Just look at the stock market today and compare it to the Great Depression of the 1930's. Both had an initial crash and then a short lived recovery before falling further into the abyss.

Contrary to popular belief, stocks are not good economic barometers. It represents the value people expect of the future worth of the company at any given moment. They are highly volatile and reactive to the news of the day.

I agree with you on this. The stock market is not a clear indicator of the economy. Instead, you have to look at trends. When you have a complete sell off, it doesn't matter which stock you own. They all go down. In good times, they all go up (mostly). Stocks recently have gone down because investors are buying Treasuries. That is an indication that the economy is on the edge and there is fear. Again, I am not a financial guru. But I think I have a decent grasp how the market works.

The government is putting in place policies that force businesses not to hire. Higher taxes, more regulation, healthcare mandates, etc. force businesses to realize how much this costs them to hire a new worker. If the cost to bring in a new work is greater than their productivity, they won't hire.

If anything future adverse regulation would cause a company to pick up cheap labor while the gettin is good. Not the other way around. The lip service about taxes is plainly false. Revenue from corporate taxes dropped nearly 100 billion dollars, in part because of rate cuts.

I'm not quite sure what you mean by future adverse regulation. Most regulation hurts businesses. There really is no such thing as cheap labor in the U.S. This is why factories and manufacturing has moved overseas. Our wages are too high to compete. We produce much less today. Just look at our trade deficit. Yes, rate cuts may have played a role in lowering corporate taxes. I'm not disputing that. In fact, companies today have the highest gross profit margin in history (34%). This was mainly achieved by cutting the labor force and increased work productivity. The private sector is very efficient. The problem is they are not hiring because they are uncertain what lies ahead due to regulation, taxes, etc.

The government can't fire workers because of their contracts. Even if the local, state, and federal government can't afford to pay their workers, they can't just fire them to cut costs.

State governments have already lost nearly 10% of their people to attrition. With the increase in demand for governemnt services, the need for public workers has gone up, not down.

I am not sure if that 10% figure is accurate. Even so, those that were laid off were not part of the labor union. You can't just lay off teachers, police, firefighters, etc.

our national debt to GDP will approach 90% in a few short years. That is when the shit will really hit the fan. If you don't believe me, look it up.

I assume you mean GDP as a percentage of the debt. Which is a meaningless number really. The United States has one of the highest production capacities in the world. It's a leader in almost every service field (medical tech, bio tech, communications, microprocessing, finance, accounting, consulting, materials research and application, consumer goods, and software); the US can comfortably support a debt that is much more than it's current GDP.