This article outlines two approaches to analyzing the law school investment. Both approaches will employ an Excel spreadsheet, the set-up of which I will walk through step-by-step. For many of you, this will be too boring and tl;dr. For others, I hope it will be a worthwhile tool.

LINK TO DOWNLOAD: Version 1.1 (LinkRemoved) (click "More" > "Download", courtesy of pizzaface)

DISCLAIMER: For educational purposes only. Does not constitute financial advice. Work in progress; may contain material errors. Do not make life decisions based on these rough spreadsheets. All inputs are dummy variables. Models require customization to be meaningful.

LIST OF WORKING ISSUES AND ERRORS

Approach 2

(1) CORRECTED. The first version had a material error in cell B29. The current version is corrected. See below.

(2) TEMPORARY FIX. The old version did not take into account increase in salary after law school. Version 1.1 sets the after law school salary to grow at the same rate you set your initial salary to grow at (cell B7, default = 4%). See the description of this fix on the second page of this thread. A more sophisticated solution may be employed later.

(3) WORKING. The current approach does not take into account the economic value of LRAPs (which, in their basic form, can be seen as a cash-or-nothing put option). I'm working on a method, although it may never come due to estimation difficulties. One should nevertheless take this into account.

Approach 1: The Pragmatic Approach

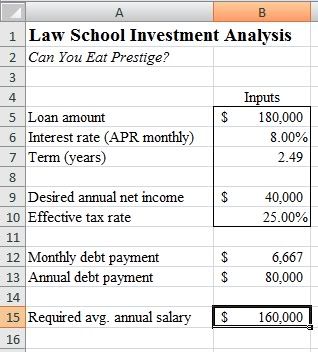

This approach will simply calculate the average salary necessary to service one’s loan. Specifically, given the desired term of the loan, the desired net income, the interest rate, and, of course, the loan amount, we will calculate the required average annual salary over the term of the loan. Here’s a screenshot of the spreadsheet:

Inputs:

In cell B5, B6, and B7, enter the loan amount, the interest rate expressed in decimal form, and the term, respectively. The loan amount is the total dollar value you will borrow to finance law school. The interest rate is the annual percentage rate (APR) with monthly payments--a standard consumer rate quote. The term is the length of time over which you hope to pay back the loan. For now, enter an 8.00% interest rate and a 10 year term.

In cell B9 enter your desired annual net income. This is the average after-tax, after-loan payment income that you think you’ll need in order to cover living expenses during the term of the loan. In cell B10, enter the effective tax rate. Twenty-eight percent is probably a conservative estimate.

Outputs:

In cell B12, enter the equation: =-PMT(B6/12,B7*12,B5,0). In cell B13, enter the equation: =B12*12. In cell B15, enter the equation: =(B9+B13)/(1-B10).In cell B15, you now have the average annual salary that you will have to earn over the term of the loan to meet your debt payments and have the net income you specified. Fiddle with the inputs.

Approach 2: The Economic Value Approach

This approach is adapted from Vanderbilt Law Professor Herwig Schlunk’s paper “Mamas Don’t Let Your Babies Grow Up To Be…Lawyers” (http://ssrn.com/abstract=1497044). However, it is in no way endorsed by Prof. Schlunk and may materially deviate from his approach as outlined in the paper. It is a much more rigorous approach consistent with theoretical economic analysis. As such, it may seem overly abstract to some people. In particular, its heavy reliance on opportunity costs can be confounding. However, it is quite rational and more sophisticated than the former approach.

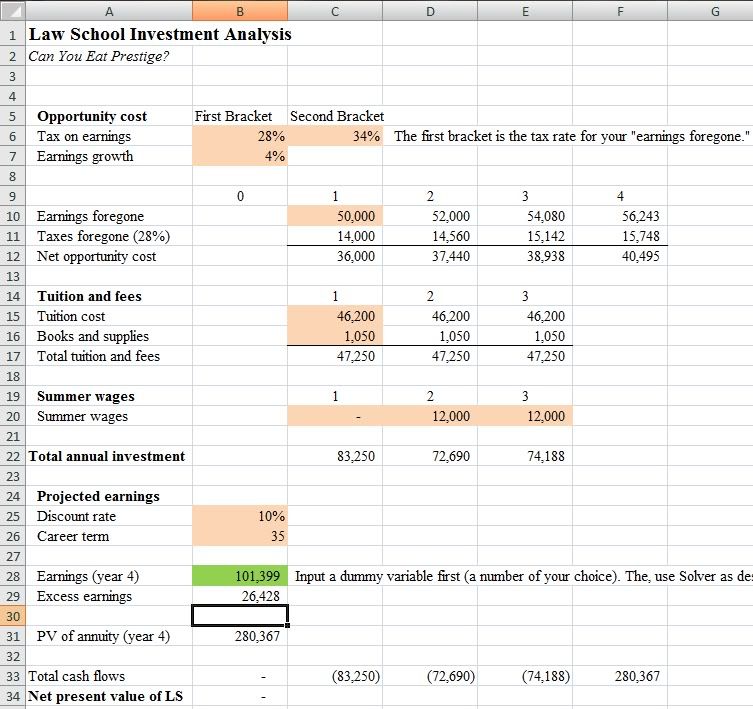

In cells B6 and B7, enter the tax rate and projected annual earnings growth, respectively. Again, we’ll use a 28% tax rate. For earnings growth, we’ll use a conservative 4% consistent with a number just above historical inflation rates. In cell C10, enter the annual salary you would have gotten if you did not go to law school. For some, this will be a projection. For others, who are quitting a job to go to law school, this will be more concrete.

In cell D10, enter the exact equation: =C10*(1+$B$7). Select cell D10. Then click on the bottom right corner and drag right until you reach column F. In cell C11, enter the equation: =C10*$B$6. Drag right to column F. In cell C12, enter the equation: =C10-C11. Drag right to column F. In cell C15 and C16, enter the annual tuition expense and estimated cost of books and supplies. Do not include living expenses. Drag both cells right to column E.

In cell C17, enter the equation: =SUM(C15:C16). Drag right to column E. In cell C20, D20, and E20, enter project annual summer earnings. To be conservative given economic conditions, these might be set to zero. In cell C22, enter the equation: =C12+C17-C20. Drag right to column E.

In B25, enter the discount rate. Start with 10%. This is arguably the most controversial input. Schlunk came under some criticism for using excessive estimates. In finance and economics, a discount rate is the rate that could be earned on investment of similar riskiness. Suffice it to say that there is no easy estimate for this figure in this scenario. In B26, enter your estimated career length as an attorney. I used 35 years (yikes). In cell B28, enter an estimated starting salary as a lawyer. This is a dummy variable for now, just use $70,000.

EDIT: To correct error. Cell B29 now has a new equation (see bold). Also, add a "second bracket" effective tax rate in cell C6. This is an estimate of your after-law school tax rate. (Some might note a circular problem here, but we'll ignore it.) Cell B31 has been changed in Version 1.1. See the second bolded equation below.

In cell B29, enter the equation: =B28*(1-C6)-F12. In cell B31, enter the equation: =(B29/(B25-B7))*(1-((1+B7)/(1+B25))^B26)*(1+B25)). In cell C33, enter the equation: =-C22. Drag right to column E. In cell F22, enter the equation: =B31. In cell B34, enter the equation: =NPV(B25,C33:F33).

Finally, we solve for the required starting salary (B28) such that the net present value of the investment (B34) is equal to zero. When the NPV of an investment is equal to zero, it is correctly priced. Thus, we’re finally getting to the meat of the analysis.

Click on cell B34. Click the “Data” tab in Excel 2007. Click “Solver” on the far right. If it’s not there, it may need to be installed as an add-in. (Google it.) The target cell should already be set to $B$34. Click the “Value of:” ratio button and set it equal to zero. Set “By Changing Cells:” equal to $B$28. Click “Solve” and click “Okay.”

The value in cell B28 is the salary you will need to earn to make law school an economically sound investment. You should run solver again using at least two higher discount rates. Average the resultant salaries.

Brief Interpretation

If you’ve made it this far, I’ll conclude the analysis. I would go into detail about the economic interpretation of the second approach, but we’re already a bit long. Thus, I’ll just get to the point.

Both approaches spit out a required starting salary. If you can rationally expect to earn this salary, law school is a good bet. If you can’t, it’s a bad bet. But what salary can you expect? Again, this is probably the hardest part. An obvious starting point is just to make a subjective guess. A better approach might be to look at the recent NLJ250 stats plus outdated and highly controversial clerkship figures (http://top-law-schools.com/forums/viewt ... 1&t=108528). Let’s say you’re looking at the University of Michigan. An expected salary could be calculated as:

Expected salary = Prob(Biglaw/Clerkship)*145,000 + (1 – Prob(Biglaw/Clerkship))*50,000 = .649 * 145,000 + (1 - .649)*50,000 = $111,655

hth