Page 1 of 1

JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Sun Sep 25, 2011 10:47 pm

by Anonymous User

Unfortunately, my grades are not the best. I graduated well below median at a school in the 20-25ish range but want to work in the nyc/nj/philly area in that order. I have a job in nyc/nj but nothing prestigious. Any chance of getting into a top LLM (for tax) program?

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Sun Sep 25, 2011 11:06 pm

by MrPapagiorgio

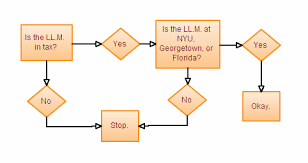

The top LLM programs that you speak of?

As for you chances? Well, I don't know. Just figured I'd get the ball rolling with the worthwhile programs.

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Sun Sep 25, 2011 11:42 pm

by Anonymous User

OP here: Specifically NYU or GTown...which ever can give me some leverage up in the mid-atlantic job market. I'm wondering if their admissions process is less competitive than the jd programs. Also, do they take urm into account?

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Sun Sep 25, 2011 11:47 pm

by CanadianWolf

Many LLM Tax programs require graduating in the top 50% of your law school class. Some require top 25% & a few also review tax law courses grades earned in your JD program.

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Mon Sep 26, 2011 12:47 pm

by Anonymous User

It's not that hard to get into the NYU or GULC tax LLM programs. What is hard is getting a job afterward. Even the NYU tax LLM only employs, generously, maybe 20% of its graduating full-time class in biglaw (and many of those had the grades/school to go straight into biglaw from law school or else actually worked in biglaw and left to do the LLM full-time).

Bottom half at a T30 is not going to get you employed post-LLM unless you do extraordinarily well in the LLM program.

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Mon Sep 26, 2011 12:58 pm

by CanadianWolf

OP: Check the admissions requirements for the LLM-Tax programs at NYU & Georgetown.

Seems as if both programs no longer require graduating in a certain % range. This must be a recent change.

P.S. Although NYU & Georgetown may no longer have set minimums, Florida recommends top 25% & some other LLM Tax programs (e.g., Emory) require graduating in the top 50% of one's JD class.

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Mon Sep 26, 2011 8:35 pm

by Anonymous User

Anonymous User wrote:It's not that hard to get into the NYU or GULC tax LLM programs. What is hard is getting a job afterward. Even the NYU tax LLM only employs, generously, maybe 20% of its graduating full-time class in biglaw (and many of those had the grades/school to go straight into biglaw from law school or else actually worked in biglaw and left to do the LLM full-time).

Bottom half at a T30 is not going to get you employed post-LLM unless you do extraordinarily well in the LLM program.

I understand. But my point here is being that I went to an out of region school and want to make myself more marketable in one of the regions that I stipulated. I suppose that an LLM at one of those schools would not hurt (albeit it would financially). I'm just wondering if the bottom half of a t20-t25 can actually get into one of these programs. Would urm help at all in this regard?

Re: JD Graduate...Interested in Doing an LLM in Tax But..

Posted: Mon Sep 26, 2011 8:49 pm

by PeanutHead

I'm currently in the JD/LLM program at GULC. Honestly the bar does not seem too high for getting into the program (both the joint degree and the post JD LLM program). I would warn against just blindly applying to this program as the TIP program (the NYU/GULC tax LLM hiring program) kind of seems like a joke. Plus there are tons of people in the LLM program that either went to a T10 and just have an interest in tax or people that finished in the top 5% of a lower T1 or T2-and I think that whatever jobs come out of TIP probably go to those people. I may be wrong on that as I'm just going off what I've heard.

I would say that if you have a genuine interest in tax to take whatever job you can find in the tax world. Work for a small tax shop, intern at IRS for free, do pro bono tax work-- just do whatever you can. Firms do need to fill tax spots on occasion and if they open up you have to be in a position to be competitive.

Best of luck, if you want to PM me I can give you some more specific info.