Re: Predict jobs in a double dip recession...or worse

Posted: Tue Jun 29, 2010 11:34 pm

mec30, I'll get the ball rolling because I am bored and not running, though there's a distinct possibility that ravens9111 is a troll (no profile information, not too bright). What the hell, it's fun to talk about anyway, and also a non-troll says he thinks the post was alright, so let's go.

Also, @Posner--you know you're a Keynesian now, right?

So by implication you must think you have a clue, since you're continuing the economics conversation. Let's see about that.ravens9111 wrote:Stick with talking about law, not economics. Most of you have no clue what's really going on

Go ahead, prove it (including your definitions of "inefficient" and "wasteful"). Also, what's your point? Governments should stop spending? See how far that argument gets you with people who have a clue what's really going on.ravens9111 wrote:It is a proven fact that government spending is inefficient and wasteful.

A majority of economists? Really? I remember hearing a number of economists argue--with Krugman--that the stimulus was not large enough to be effective. That was a pretty standard criticism from the Keynesian crowd. Also, of course there is a multiplier effect for the private sector: that's the whole point of stimulus spending ("multiplier effect" was Keynes' term for the gift-that-keeps-on-giving nature of consumption). If a new road is built with stimulus money, the government isn't building that road; a private construction firm is. That firm takes its stimulus money and pays its workers, who go out and buy some stuff they wouldn't have ordinarily, and the people who sold them that stuff take the proceeds and go buy stuff of their own...and the original firm may also buy stuff it wouldn't have otherwise, and so on...and there's your multiplier effect.ravens9111 wrote:The stimulus package was opposed by the majority of economists because the money to be spent did not have a multiplier effect for the private sector.

I don't know what arbitrary time frame you're using, but whatever, suppose you're right; so what? That's like saying "When you take into account the next 50 years, the total defense spending our country faces is $30 TRILLION!" Fortunately budgets take things one year at a time. Check back in a few years and see how our debt-to-GDP ratio is doing. It's been increasing since Bush II took office; the key is to turn that trend around before we turn into Japan.ravens9111 wrote:When you take into account for social security and pensions, the real debt our country faces is over $100 TRILLION.

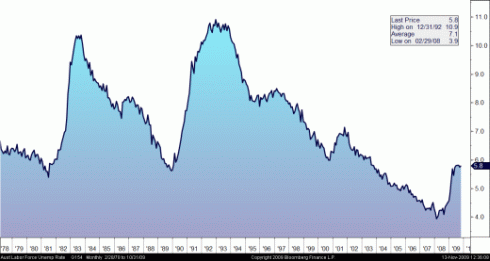

Yes on the first count (we haven't had a 2010 double-dip yet), but why did the US fall further into the abyss in 1937? Arguably because New Deal stimulus spending was rolled back, cutting off part of the economy's air supply just as its lungs were coming back online. It's a complex story, but that's part of it.ravens9111 wrote:The worst is not behind us folks. Just look at the stock market today and compare it to the Great Depression of the 1930's. Both had an initial crash and then a short lived recovery before falling further into the abyss.

It's projected to hit 100% by 2015. Like I said, the key is to get that ratio headed back the other way. However, Japan's ratio is over 200%, I believe, and even so, Japan hasn't exactly spontaneously combusted. Also, our ratio was 117% when Truman took office. Hey, it's great to be China right now--running crazy surpluses and buying up the world--but we can't get there overnight (and probably won't ever get there given that the US is a democracy). Getting the economy going again has to be job #1, and the austerity route is pretty clearly not the short-term cure for what ails us.ravens9111 wrote:Spending your way out of a recession/depression will prove disastrous as our national debt to GDP will approach 90% in a few short years. That is when the shit will really hit the fan. If you don't believe me, look it up.

Also, @Posner--you know you're a Keynesian now, right?